20/F, Building 5, Yard 1, Yuetan South Street, Xicheng District, Beijing China Code:100033

Tel: 010-68063910 Fax: 010-68066630

Copyright 2004-2017 All Rights Reserved. China Trustee Association

京ICP备 19023601号

I. Decline of Trust Assets and Expansion of proprietary Assets

A. Trust Assets

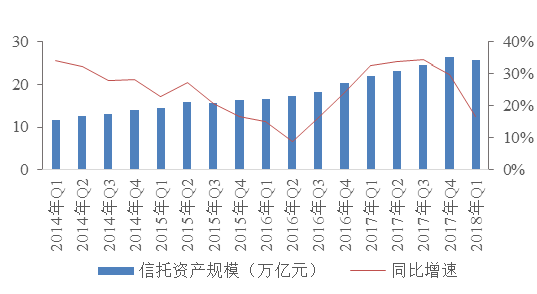

As of 2018 Q1, the trust assets under management of 68 trust companies were 25.61 trillion Yuan, dropped by 2.41% since 2017 Q4. It was the first negative growth in recent two years. The Y-o-Y growth rate decreased further to 16.6% from 29.8% in 2017 Q4. Financing trust totaled 4.43 trillion Yuan, showing a mild decrease of 3.5 billion Yuan since 2017 Q4. It accounted for 17.28% of the total, showing an increase from 16.87% of the end of 2017. Investment trusts totaled 6.05 trillion Yuan, decreased by 124.5 billion Yuan since 2017 Q4. It accounted for 23.60% of the total, increased from 23.51% of the end of 2017. Non-discretionary management trusts decreased by 504.4 billion Yuan to 15.14 trillion Yuan since the end of 2017. Although its proposition was still nearly 60%, it dropped by 0.5 percentage point since the end of 2017. It ended a consecutive growth since 2014. These data showed impacts of supervisory agency’s effort to contain chaos of trust channels and urge the trust industry to return to its origin. A number of trust companies actively responded to regulatory policies and controlled their scale and growth rate. The scale of the so-called channel business was significantly reduced, and the industry's excessive growth momentum was curbed. The measures of renovating chaos and containing risk in trust industry began to work. It was expected that the growth rate of trust assets in the next quarter would continue to decline.

Chart 1: Size of trust assets and quarterly growth rate from Q1 2014-Q1 2018

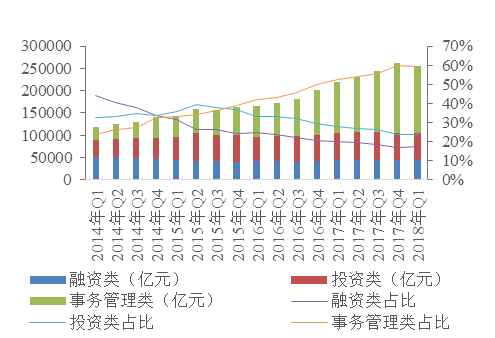

In terms of the sources of assets, as of 2018 Q1, the proportion of single pecuniary trusts decreased by 0.19 percentage point to 45.54% compared with that of 2017 Q4. The proportion of collective pecuniary trusts was increased by around 1 percentage point to 38.73%, compared with that of 2017 Q4. The proportion of property trusts was decreased by 0.8 percentage point to 15.73% on a quarterly basis. Although the proportion of single pecuniary trusts still accounted for about half of trust assets, it decreased Y-o-Y. Affected by decline in cooperation between trust companies and banks as well as limitation on capital sources from banks, the proportion of single pecuniary trusts could be further reduced. As trust companies increasingly improved their active management capability, the proportion of collective pecuniary trusts was expected to rise steadily.

Chart 2: Size and proportion of trust assets in terms of functions from 2014 Q1 to 2018 Q1

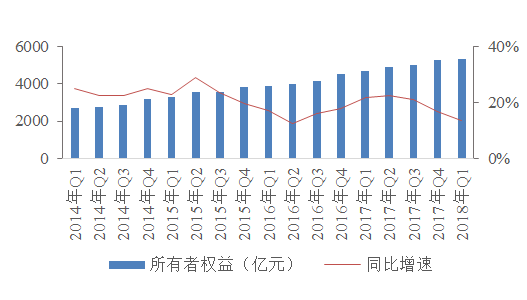

B. Proprietary Assets

As of 2018 Q1, proprietary assets totaled 668.23 billion Yuan, increased by 15.74% since Q1 2017 and 1.57% since 2017 Q4, which was the result of an increase in registered capital and profitability.

In terms of asset categories, investment assets were still the largest proportion, showing a slight upward trend. Its proportion in 2018 Q1 was 78.45%, increased by 3.04 percentage points compared with 2017 Q4. The proportion of currency assets and loan assets were decreased by 3.53 percentage points and 0.92 percentage point respectively on quarterly basis. The declining proportion of investment assets reflected that trust companies were paying more and more attention to efficiency of the use of proprietary assets and they allocated more funds to long-term equity and securities.

In terms of components of owner’s equity, as of 2018 Q1, paid-in capitals were 246.36 billion Yuan, accounting for 46.22% of total. It increased by 0.17 percentage point on a quarterly basis. Undistributed profits were 158.69 billion Yuan, accounting for 29.77% of the total, a mild increase of 0.25 percentage point. Capital strength of trust companies was the major focus of the supervisory departments. It was expected that trust companies would further improve capital position.

Chart3: Changes in the owner's equity from 2014-2018

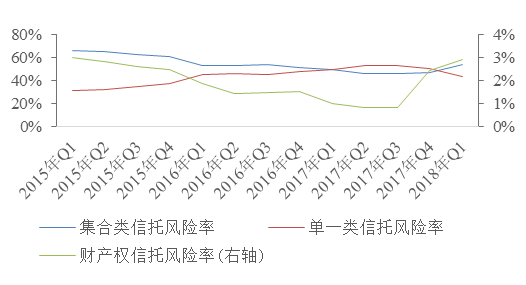

C. Projects at Risk

As of 2018 Q1, 659 projects were at risk and the amount of these projects was 149.13 billion Yuan. The risk ratio of trust assets stood at 0.58%, with a quarterly increase by 0.08 percentage point. Among them, collective trusts accounted for 53.53% of the total, increased by 6.37% since 2017 Q4. It was mainly resulted from restricted financing sources for real estate business and frequent default of government platform companies. In the context of breaking the rule of rigid redemption, new risk projects and risk ratios could slightly increase further. However, trust companies' active management capabilities and risk control capabilities would be strengthened simultaneously. Generally speaking, risks of the industry were still manageable.

Chart4: Changes of risk ratio from 2015 Q1 -2018 Q1

II. Business Performance Improved while Rate of Return Fell

A. Business Performance

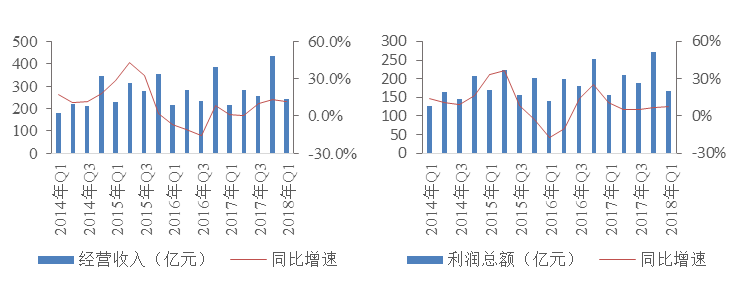

In 2018 Q1, income of the trust industry amounted to 24.34 billion Yuan, increased by 11.98 percentage points since 2017 Q1. The profit of the industry amounted to 16.77 billion Yuan, increased by 8.39 percentage points since 2017 Q1. A single-digit growth rate was maintained for the previous four consecutive quarters.

Chart 5: Changes in quarterly incomes, profits, and growth rate from 2014 Q1 to 2018 Q1

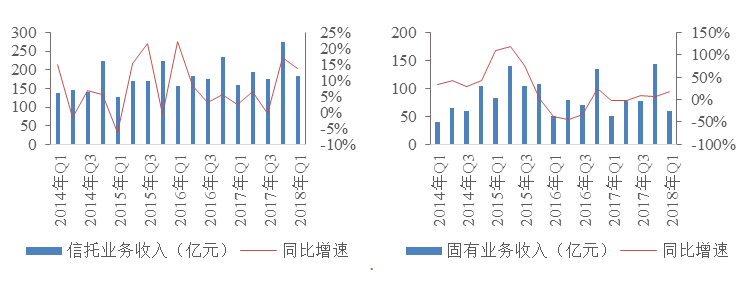

B. Income Structure

In 2018 Q1, trust business income was 18.20 billion Yuan, increased by 13.75% since 2017 Q1. It accounted for 74.80% of the total, increased by 7.18 percentage points on a quarterly basis. proprietary business income was 5.88 billion Yuan, increased by 18.16% since 2017 Q1. It accounted for 24.14% of the total, dropped by 5.03 percentage points on a quarterly basis. The central government continued to emphasize that the financial industry should serve the real economy. In this context, the trust companies strived to return to the origin. The trust business remained the main source of profit growth for the industry.

Chart 6: Changes in trust business income and proprietary business income from 2014 Q1 to 2018 Q1

C. Operation Efficiency

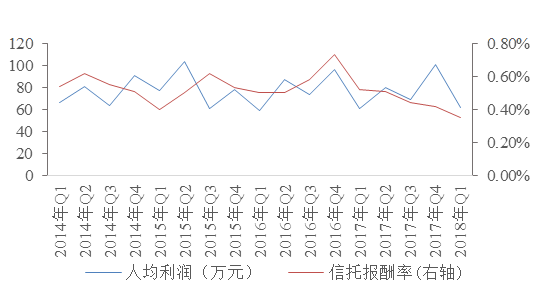

In terms of per capita profit, it was 614500 Yuan in 2018 Q1, increased by 0.36% since 2017 Q1. The per capita profit remained stable during past four years. It showed that in the context of financial deleverage and risk control, governance structure in trust companies was continuously optimized. Active management capabilities as well as risk control continued to improve. Middle and back office Infrastructure was enhanced, human resources in the middle and back office was strengthened, and per capita profitability became more sustainable and sophisticated.

In terms of return rate, average comprehensive annual return rate for the beneficiary was 0.35%, which was the lowest in the past two years. Along with introduction of new regulations of asset management, channel business was gradually cleared out. The business structure was expected to adjust faster and the return rate would increase.

Chart 7: Changes in Per Capita Profit and Return Rate from 2014 Q1 to 2018 Q1

III. Business Transformation advanced and Service to Real Economy Improved

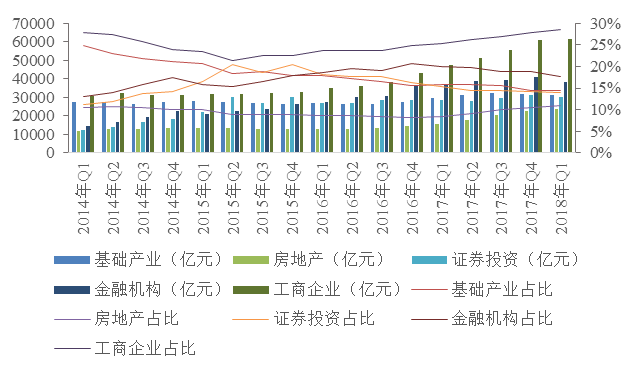

The trust industry should serve the real economy, as what was prescribed in the policy guidelines of the Central Economic Work Conference. It should promote a virtuous circle between the financial industry and the real economy. It also should fulfill its responsibility of containing and addressing risks. In terms of asset allocation in 2018 Q1, funding to industrial and commercial enterprises remained the largest proportion of the total, followed by financial institutions, basic industry, securities investments and real estate industry. Compared with 2017 Q4, proportions of industrial and commercial enterprises as well as real estate enterprises increased, while proportions of basic industry and securities investments declined.

Chart 8: Changes in the trust funds allocation and proportions from 2014 Q1 to 2018 Q1

A. Industrial and Commercial Enterprises

Industrial and commercial enterprises were the major area of trust investments since 2012 Q2. As of 2018 Q1, industrial and commercial enterprises investments amounted to 6.15 trillion Yuan, increased by 0.9% since 2017 Q4. The proportion was 28.52%, increased by 0.68 percentage point since 2017 Q4. New project investments accounted for 26.24% of the total, increased by 1.23 percentage points since 2017 Q4. Trust companies actively responded to the call to serve the real economy and increased investments in strategic emerging areas. For example, funding to information transmission, computer and software industries reached 267.39 billion Yuan, increased by 13.43% since 2017 Q1.

B. Financial Institutions

As of 2018 Q1, investments to financial institutions amounted to 3.84 trillion Yuan, decreased by 6.61% since 2017 Q4. The proportion was 17.78%, dropped by 0.98 percentage point on a quarterly basis .New project investments accounted for 9.19%, declined by 3.07 percentage points on a quarterly basis. The proportion of investments to financial institutions decreased gradually since 2017 Q1. It was due to the central government's efforts to clean up inter-bank business and eliminate regulatory arbitrage in recent years. It was expected that peer-to-peer cooperation would gradually return to rational level.

C. Basic Industry

As of 2018 Q1, investments to basic industry trust were 3.11 trillion Yuan, dropped by 2.07% since 2017 Q4. The proportion was 14.40%, dropped by 0.09 percentage point on a quarterly basis. New project investments accounted for 9.19%, declined by 1.39 percentage points since 2017 Q4. The government continued to contain risks of local government debt, and clear up illegal borrowing of local governments and disguised funding to PPP’s. As a result, investments to basic industry were predicted to shrink further.

D. Securities Investments

As of 2018 Q1, trust investments in securities market amounted to 2.99 trillion Yuan, accounted for 13.86% of the total. It was dropped by 3.53% and 0.29 percentage point since 2017 Q4. New project investments accounted for 6.73%, declined by 0.98 percentage point since 2017 Q4. Affected by new regulations of asset management, non-standard investments were strictly controlled and standard securities assets investments were expected to increase.

E. Real Estate Industry

As of 2018 Q1, investments to real estate industry amounted to 2.37 trillion Yuan, increased by 3.87% since 2017 Q4. The proportion increased by 0.57 percentage point to 10.99% on a quarterly basis. New project investments accounted for 10.27%, increased by 1.11 percentage points since 2017 Q4. At present, financing demand for real estate enterprises was mounting. Under pressure of strict regulation in the real estate market and rigid financial supervision,financing sources including bonds, bank loans, and equity investments could be further controlled. Demand for trust financing would remain strong in the near future.

IV. Adapted to Regulatory policy and Seized Transformation Opportunities

A. Strict Regulation sustained and Cutting of Trust Funding continued

Under central government’s guiding policy of “de-leverage and risk prevention”, trust companies actively responded and downsized trust assets. As of 2018 Q1, the growth rate of trust assets on a quarterly basis turned from positive growth to negative growth. Accompanied by new regulations of asset management, channel business and model of multiple layers of nesting would be eliminated. Standardizing non-standard investments and breaking the rule of rigid redemption would become the main focus of the supervisory departments. Meanwhile, the demand from banking asset management for trust products would be reduced, and the size of fund trusts was expected to shrink.

B. Deleverage continued and the Default Risk emerged

Recovery of global economy continued since 2016 H2 and the trust industry enhanced capital strength. Profitability of trust companies remained strong. Solvency position was enhanced and risk control was improved. However, defaults in bond market became more frequent recently. A number of trust companies were involved, and default risk on trust products started to grow.

C. Restrictions on Traditional Business and Expansion to Emerging areas

With the guidance of containing risks, strict compliance, stable transformation and quality growth, compliance risk in business with real estate industry and government financing platform would increase. Business expansion became even more difficult. The business focus of the trust companies would gradually expand from real estate industry, government financing platforms to emerging industries such as consumption and industry upgrading. For example, with the increase in per capita disposable income and renewed concept of advanced consumption, business opportunities for consumption finance are huge. As numbers of HNWIs in

D. Responded to Strategic call and Stepped up Efforts to Serve the Real Economy

The 2017 National Financial Working Conference determined that the financial industry should “return to origin”, “serve the real economy” and “contain risk”. As a substantial part of the financial industry, the trust industry should always focus on serving the real economy. The trust industry has more flexibility since trust assets can be invested in the money market, capital market and industrial market. Trust companies should actively support implementation of major national strategies such as “Made in China 2025”, “One Belt One Road initiative”, “military-civilian integration” and “rural revitalization”.