20/F, Building 5, Yard 1, Yuetan South Street, Xicheng District, Beijing China Code:100033

Tel: 010-68063910 Fax: 010-68066630

Copyright 2004-2017 All Rights Reserved. China Trustee Association

京ICP备 19023601号

In 2018 Q2, the growth of China’s trust industry continued to slow down. Due to influence of the new regulation on asset management and regulatory policies, the size of the trust assets under management declined continuously, and industry profitability dropped mildly. This also reflected positive signal including optimization of assets structure, enhancement of capital strength, improvement of active management capacity and speed-up of transformation and development. The trust industry is transforming from high speed growth to high quality development.

I. Slow-down of asset growth and improvement of structure

In 2018 Q2, due to influence of regulatory policies including "deleveraging and controlling of channel business", the size of trust assets continued to decline. The biggest fall was witnessed in channel business of single fund trust and non-discretionary management trust. The structure of trust assets was significantly optimized with improvement of active management and quality of growth.

A. The size of trust assets shrinked

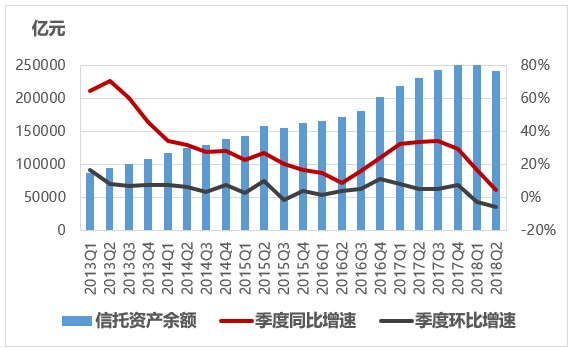

In 2018 Q2, the size of trust assets under management declined. The balance was 24.27 trillion Yuan, decreased by 1.34 trillion Yuan from 25.61 trillion Yuan in 2018 Q1. This is the first negative growth of trust assets since 2010 when the industry’s quarterly statistics started. In terms of quarterly growth rate, it decreased since 2017 Q4. The growth rates of last three quarters were 29.81%, 16.60% and 4.88% respectively. The size of trust assets in 2018 Q2 returned to the original level between 2017 Q2 and 2017 Q3. In terms of quarter-on-quarter growth rate, it remained relatively stable. In the first two quarters of 2018, the growth rate was -2.41% and -5.25%. It showed stable downward trend without significant fluctuation.

Figure 1-1 Growth of trust assets

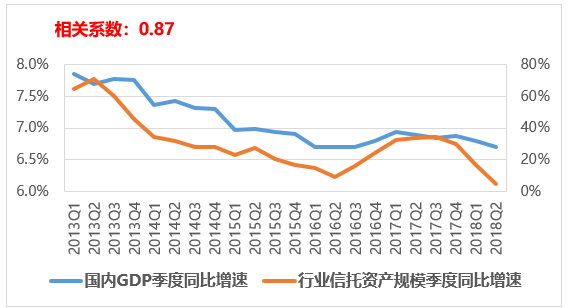

The continuous and steady fall in the size of trust assets was closely related to macroeconomic and regulatory environment. In the first half of 2018, macroeconomic growth slowed down steadily from 6.8% in Q1 to 6.7% in Q2. The growth rate of the proprietary assets investment was 6.0%, down 1.5 percentage from Q1. Total retail sales of social consumer goods grew by 9.4% Y-o-Y, decreased by 0.4 percentage point. The surplus of imports and exports was 901 billion Yuan, decreased by 26.7% Y-o-Y. Since 2013, the correlation coefficient between the growth rate of trust assets and GDP reached 0.87, and their growing trends were broadly consistent. In the first half of 2018, apart from impacts of slowdown of GDP growth, the decline in trust assets was partly caused by introduction of new regulatory policies and enforcement action.

Figure 1-2 Growth rate of trust assets and GDP

B. The size of single fund trust and non-discretionary management trust decreased significantly

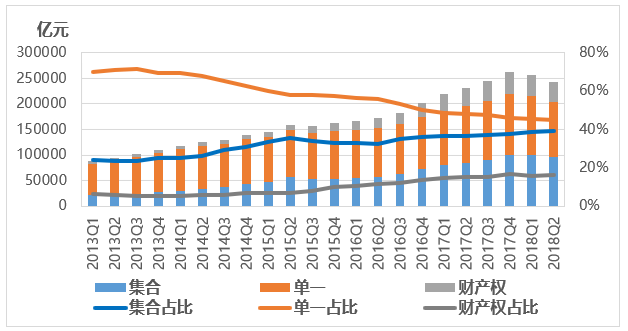

The size of single pecuniary trusts and non-discretionary management trusts declined continuously and steadily. The structure of trust assets was thus further optimized.

Firstly, in terms of sources of assets, the size of single pecuniary trusts decreased fastly and its proportion also continued to decrease. In Q2, the size of single pecuniary trusts decreased by 7% from 11.66 trillion Yuan in Q1 to 10.84 trillion Yuan. The size of collective pecuniary trusts dropped slightly by 4.1% from 9.92 trillion Yuan to 9.51 trillion Yuan. The size of property trusts dropped slightly by 2.9% from 4.03 trillion Yuan to 3.91 trillion Yuan. The proportion of single pecuniary trusts decreased continuously since 2013 Q3. It was 44.68% in 2018 Q2, down 0.84 percentage point from 45.54% in 2018 Q1. The proportion of collective pecuniary trusts increased to 39.20% in Q2, up 0.48 percentage point from Q1. The proportion of property trusts also increased slightly to 16.12% in Q2, 0.39% percentage point higher than Q1. The decline of single pecuniary trusts contributed significantly to the decline of of the size of trust assets and the contribution rate was 61.05%.

Figure 1-3 Changes in source of trust assets

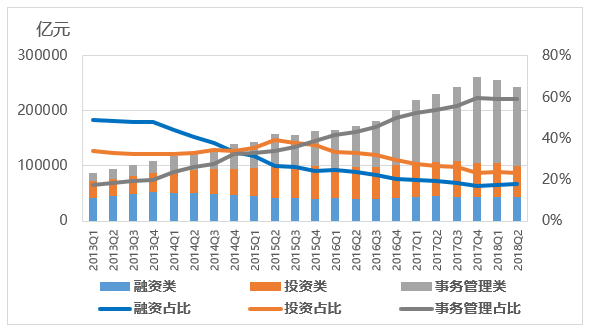

Secondly, in terms of function of trust assets, the size and proportion of non-discretionary management trusts declined simultaneously. In Q2, the size of non-discretionary management trusts declined significantly, from 15.14 trillion Yuan in Q1 to 14.30 trillion Yuan, with a decrease of 841.4 billion Yuan. The size of investment trusts declined from 6.05 trillion Yuan in Q1 to 5.59 trillion Yuan, with a decrease of 455.8 billion Yuan. The size of financing trust declined from 4.43 trillion Yuan in Q1 to 4.38 trillion Yuan, with a decrease of 47.5 billion Yuan. Non-discretionary management trusts accounted for 58.93% in Q2, down 0.19 percentage point from Q1. Investment trusts accounted for 23.03%, down 0.57 percentage points, and financing trusts accounted for 18.04%, up 0.76 percentage point. The deciline of non-discretionary management trusts was the major factor causing the decline of trust size. Non-discretionary management trusts accuouted for 62.57%.

Figure 1-4 Changes in the use of trust assets

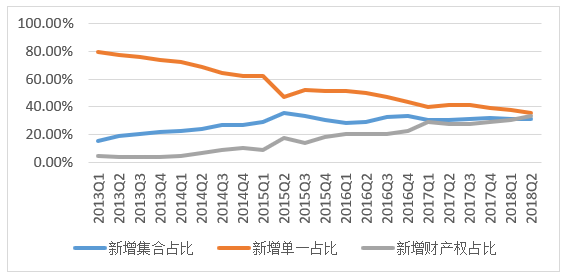

C. The source of trust asset growth was optimized

In terms of new asset growth, the proportion of single pecuniary trusts was decreasing since 2013, while both the collective pecuniary trusts and the property trusts increased. In terms of growth in 2018 Q2, the proportion of single pecuniary trusts dropped to 35.30% from 37.81% in 2018 Q1, with a decrease of 2.51 percentage points. The proportion of property trusts rose to 33.47% from 30.66% in 2018 Q1. The proportion of collective pecuniary trusts was slightly decreased to 31.23% from 31.53% in 2018 Q1.

This structural change reflected strengthened supervision and enforcement action. The channel business manifested by single pecuniary trusts was strictly regulated. After promulgation of the new regulations on asset managements, the property trusts grew rapidly. For instance, asset securitization witnessed rapid growth in the first half of 2018 since it was able to fully unitize the industry’s institutional advantages. The decrease in the proportion of single pecuniary trusts and the increase of property trusts reflected optimization of business structure in Q2.

Figure 1-5 Changes in source of new trust asset

D. Business Cooperation between trust companies and banksdeclined significantly.

In December of 2017, the China Banking Regulatory Commission issued The Notice on Regulating Business Cooperation between Trust Companies and Banks. In 2018, the China Banking Regulatory Commission issued The Notice on Clearing up Chaos in Banking Market, which strictly restricted channel business aiming to supervisory arbitrage. A series of regulatory policies strengthened the supervision of business cooperation between trust companies and banks, reversing rapid growth momentum since 2017. In 2018 Q1 and Q2, the size of business cooperation between trust companies and banks declined continuously, mainly due to the strict control of channel business, which brings benefit to long-term quality development of the industry.

II. Profitability dereased mildly

A. Operating income and profits decreased

In Q2, profitability of the industry was lower than Q1. The income as well as profit declined Y-o-Y and per capita profit also dropped. However, income of the trust business was still essential to maintaining profitability level of the industry. On the one hand, the fluctuation of profitability was the inevitable result of clearing out of the channel business, squeezing the business size and slowing-down of massive growth. On the other hand, it also reflected impacts of steady decline of macro-economy and increase volatility of capital market.

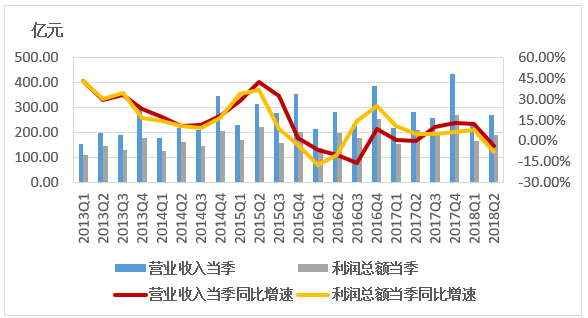

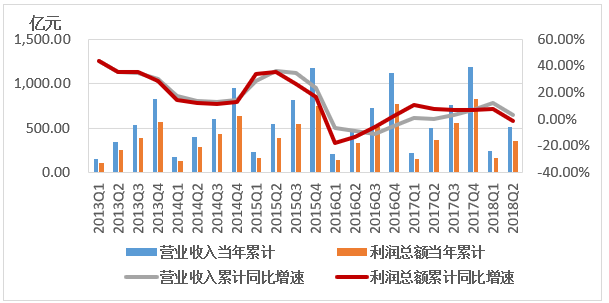

In 2018 Q2, the total income and profit of the industry decreased Y-o-Y. The industry achieved income of 27 billion Yuan in Q2, with an increase of 10.93% from 24.34 billion Yuan in Q1. However, excluding seasonal factors, the Y-o-Y growth rate deceased by 3.94% from 2017 Q2, which was also the lowest level since 2016 Q4. The industry added profits of 19.24 billion Yuan in Q2, with an increase of 14.74% from 16.77 billion Yuan in Q1. However, the growth rate dropped by 8.16%, much worse than drop of operating income.

Figure 2-1 Operating income, profit and growth rate

The total income reached 51.33 billion Yuan in Q2 and the average income per company was 755 million Yuan, with a Y-o-Y increase of 3.11%. The absolute figure did not decline, but the growth rate dropped by 9.14% quarterly. The profit in Q2 reached 36.005 billion Yuan. The average income per company was 529 million Yuan, down 1.32% Y-o-Y and the growth rate dropped by 9.24% since Q1. It was estimated that if profitability in Q3 and Q4 could not be significantly improved, the annual income and profit would drop simultaneously.

Figure 2-2 Operating income, profit and growth rate

B. Growth rate of trust business income declined

In Q2, the growth rate of trust business income slowed down with shrinking size of trust assets. The trust business income of 68 trust companies reached 36.24 billion Yuan, average 533 million Yuan per company. The growth rate was only 2.11% Y-o-Y, down 11.52% from 13.63% in Q1. In Q2, the trust business income increased by 18.83 billion Yuan, with a slight decrease of 172 million Yuan compared with Q1. The average income per company was 265 million. The Y-o-Y growth rate dropped from 13.63% in Q1 to -7.38%. It showed that not only the growth rate fell sharply, but also the absolute figure of income fell slightly Y-o-Y. Two major factors caused the continuous decline of income in Q2. The first factor was the decline of the asset size. Under influence of regulatory policies, trust assets declined by 1.34 trillion Yuan in Q2, which would have long-term impact on income. Secondly, liquidity of the monetary market was tightened. Funding from banks was restricted and it was difficult to raise funds for active management trust products. Successful establishment of trust plan with higher return rate became more difficult, both of which negatively affected business income growth.

Figure 2-3 Changes in trust business income and growth rate

Figure 2-4 income growth of inherent growth

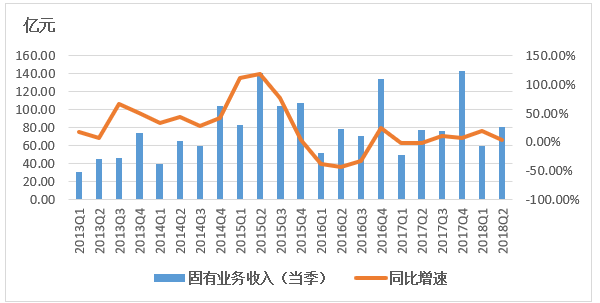

C. Proprietary businesses income increased sightly

Revenue of proprietary businesses in Q2 increased slightly and remained relatively stable, showing a different growth trend. The proprietary income in Q2 was 8.01 billion Yuan, with a growth rate of 3.15% Y-o-Y. Although it was much lower than the 18.16% in Q1, it still maintained a positive growth. The business income of Q1 and Q2 was 13.89 billion Yuan, average 204 million Yuan per company. The business income in Q1 and Q2 increased by 9.01%, most of which was realized in Q1.

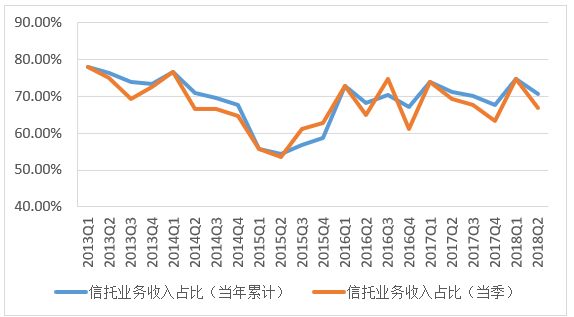

D. The proportion of trust business income remained high

Trust business remained the core business of trust company and trust business income was also dominant. Trust business income accounted for 70.59% of total business income. Although the proportion was slightly lower than 74.80% in Q1, it maintained at a very high level, even higher than the figures in 2017 Q3 and Q4. The trust business income accounted for 66.79% of total in Q2, down by 8.01 percentage points, maintaining at a high level.

Figure2-5 Changes in proportion of trust business income

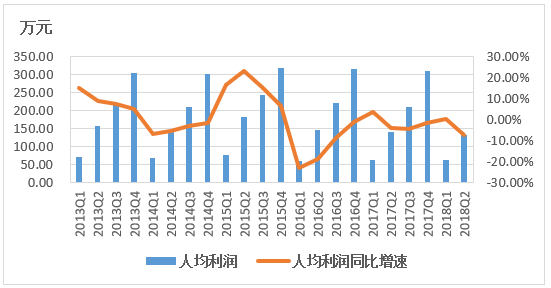

E. Per capita profit was lower

In Q2, per capita profit was 1.31 million Yuan, down 7.33% from 1.41 million Y-o-Y. Its growth rate was 7.69%, lower than that in Q1.

Figure2-6 Per capita profit and its growth rate

III. Capital strength was enhanced

Although the size of trust assets declined slightly for two consecutive quarters, the industry's capital strength was strengthened with increase of paid-in capital. Meanwhile, he proprietary capital was mainly used for investment and thus liquidity demand.of proprietary capital increased.

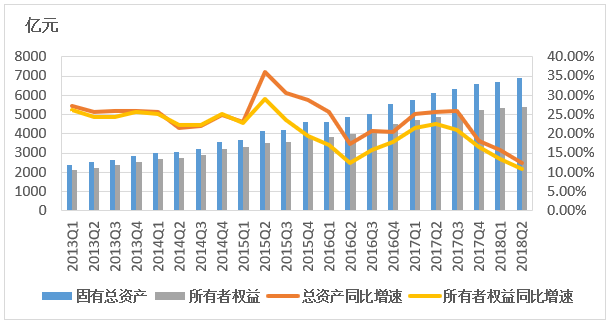

A. Size of proprietary assets continued to grow while the growth rate become slow

Capital strength guaranteed sustainable development of the industry. The size of proprietary assets maintained a steady upward trend. In 2018 Q2, it reached 689.33 billion Yuan, increased by 21.1 billion Yuan since Q1. The average size of proprietary assets of 68 trust companies was 10.14 billion Yuan. The size of owner's equity reached 54.98 billion Yuan, with an increase of 8.98 billion Yuan since Q1. The average size of owner's equity was 7.97 billion Yuan.

The growth rate of proprietary assets and owner's equity slowed down significantly. Proprietary assets grew 12.46% Y-o-Y in Q2, down from 15.74% in Q1, declining for three consecutive quarters. Owner equity grew by 10.97% Y-o-Y in Q2, down 2.55 percentage points from 13.52% in Q1, declining for four consecutive quarters.

Figure3-1 Changes in inherent assets and owners' equity

B. Paid-in capital increased

Although paid-in capital kept on increasing steadily since 2013, it increased even faster since 2016. In 2008 Q2, it reached 258.03 billion Yuan, with an average capital of 3.80 billion Yuan per company, up by 16.33% Y-o-Y and 4.75% since Q1. Although growth rate slowed down, the growth of total size was still significant.

Figure3-2 Size of Paid-in capital and growth rate

The increase in the paid-in capital was mainly due to additional capital share. Three factors caused constant capital demands of trust companies. Firstly, business expansion demanded more capital because trust companies with firm capital position would have more advantages in competition. Secondly, net capital management called for more capital. Thirdly, liquidity pressure of inherent assets was tightening. In the past three years, a number of trust companies increased their capital positions. In 2016, 22 trust companies increased registered capital by 38.57 billion Yuan, average increase of 1.75 billion Yuan per company. In 2017, 21 trust companies increased registered capital by 40.31 billion Yuan, average increase of 1.92 billion Yuan per company. In 2018 Q1 and Q2, 7 trust companies increased registered capital by 17.64 billion Yuan, average increase of 2.52 billion Yuan per company.

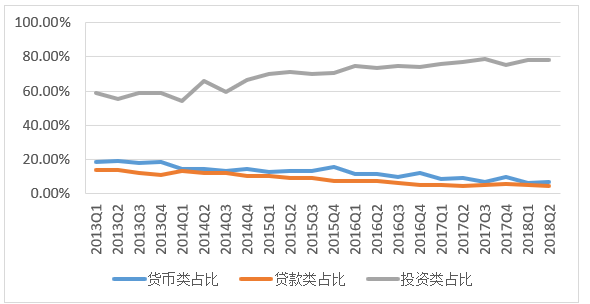

C. Proprietary assets were allocated to investment

Since 2013, the proportion of investment kept rising, from 58.86% in 2013 Q1 to 78.05% in 2018 Q2, up 19.19%. In Q2, this proportion declined slightly from 78.45% in Q1. It was still dorminant compared with 6.90% of money assets and 4.63% of loans, both of which declined since 2013.

Figure3-3 Structural changes in inherent assets allocation

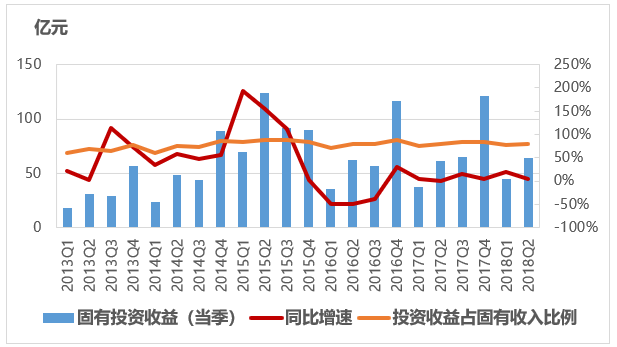

The increasing proportion of investment was also reflected in increase of proportion of proprietary investment income. Since 2013, except for the Y-o-Y decline in 2016 Q1 to Q3, the proprietary investment income maintained steady growth. In 2018 Q2, the proprietary investment income increased by 6.39 billion Yuan quarterly, accounting for 79.74% of the total. Influenced by external environments including capital market volatility, the growth rate of inherent investment income in Q2 was merely 3.83%, significantly lower than 20.44% in Q1.

Figure3-4 Changes and proportion of inherent investment income

D. Liquidity demand of proprietary capital was growing

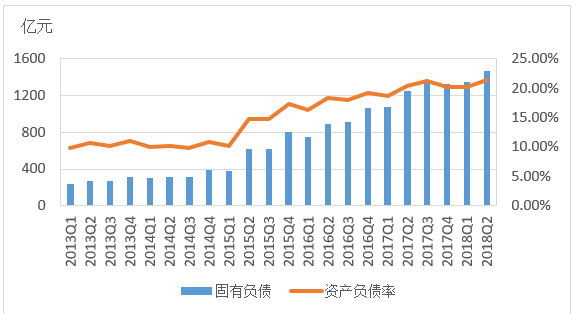

In recent years, the gap between proprietary assets and owner's equity was widening because short-term funds mainly came from borrowing in the interbank market or liquidity support from the Trust Guarantee Fund Companies. In 2013 Q1, the proprietary liabilities were 23.23 billion Yuan, increased by 534.17% to 147.34 billion Yuan in 2018 Q2. Although it declined in 2017 Q4, growth resumed rapidly in 2018 Q1 and Q2, reaching its highest level in recent years. Increasing proprietary liabilities led to increase of proprietary asset-liability ratio. The ratio reached 21.38% in 2018 Q2, the highest point since 2013. Because both proprietary assets and capital were rising simultaneously, the asset-liability ratio of the industry was still managerable.

Rising of this ratio reflected growing demand for liquidity of proprietary capital. The major reason behind was tight liquidity in the monetary market in the first half of 2018. Funding from banks was strictly restricted. Since establishment of new funding plan became more difficult, proprietary assets were used for project investment as a back-up funding source. Trust companies’s own liquidity was squeezed. Transformation and development of the industry would continue in the future. More focus would be put on active management business. It was estimated that demand for proprietary capital liquidity would further increase.

Figure3-5 changes in inherent liabilities and asset-liability ratio

IV.Majority of trust Funds went to real economy

A. Industrial and commercial enterprises investment declined

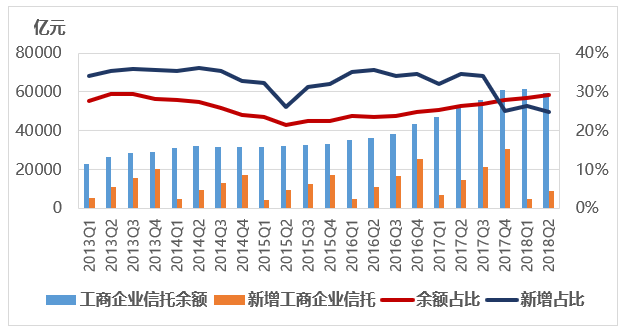

In Q2, allocation of trust funds (excluding property trust) changed slightly. Funding to industrial and commercial enterprise declined slightly, while the proportion was increasing. Funding to real estate enterprise increased significantly. Funding to the basic industry and securities investment continued to decline. As a whole, the proportion of funding to industrial and commercial enterprises, real estate and basic industries rose from 53.91% in Q1 to 56.12%. It indicated that majority of trust funds was allocated to real economy.

Majority trust investment went to industrial and commercial enterprises in Q2. The balance reached 5.95 trillion Yuan, slightly lower than 6.15 trillion Yuan in Q1. Due to decline in the size of trust assets, the proportion rose from 28.52% to 29.23%, with an increase of 0.71 percentage point. The growth in Q2 was 869.60 billion Yuan, much lower than 1.47 trillion Yuan in 2017 Q2. The proportion also dropped from 26.24% in Q1 to 24.75% in Q2. Although the proportion was still high, it also showed that growing momentum was weakening.

Figure4-1 Industrial and Commercial Trust(Balance、growth and proportion)

The decrease of trust investment to industrial and commercial enterprises was closely related to macro-economy and performance of industrial and commercial enterprises. According to statistics, the growth rate of trust investment to industrial and commercial enterprises was highly correlated with that of industrial added value since 2012 with coefficiency of 0.804. Since 2013 Q1, the growth rate began to decline Y-o-Y and touched the lowest point in 2015 Q2, copying the trend of the broad industry. It went up together with recovery of the industrial and commercial enterprises. Since 2018 Q1, the growth rate of industrial added value was brought down with macro-economy, trust investments growth slowed down even more signifanctly.

Figure4-2 Growth Rate of Industrial and Commercial Trust and the Industry

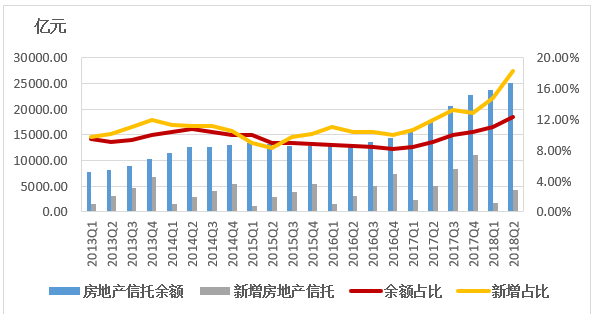

B. More trust funds were allocated to real estate sector

The sustainable and healthy development of the real estate industry played an important role in economic growth. Although funding to real estate enterprises were under stict control, the trust industry supported the industry growth via various forms of products. The reason behind was that trust companies were able to utilize diversified financial instruments subject to supervisory rules and regulationst. Generally speaking, the real estate sector played a positive role in the stable growth of macro-economy. In 2008 Q2, the size of trust investment to real estate sector was 257.25 billion Yuan, with an increase of 136.17 billion Yuan from 237.18 billion Yuan in Q1. Its proportion rose from 10.99% to 12.32%. The size of new real estate trust in Q2 totaled 428.07 billion Yuan, accounting for 18.31% of the total, 3.5 percentage points higher than Q1. It was obvious that more trust funds went to real estate sector in the first half of 2018.

Figure4-3 real estate trust (balance, growth and proportion)

C. Trust investment to infrastructure industry declined significantly

Due to tightening of local government financing, trust investments to infrastructure industry declined for three consecutive quarters since 2017 Q3. In 2018 Q2, the size was 296.75 billion Yuan, down by 141.62 billion Yuan from 310.367 billion in 2018 Q1. Its proportion increased slightly to 14.57%. It increased by 228.32 billion Yuan in Q2, only accounted for 9.77% of the total growth. Its proportion was 0.2 percentage point lower 2018 Q1.The Y-o-Y decrease was more significant, and the total size only equivalent to 39.06% of 584.48 billion Yuan in 2017 Q2. The status of basic industry for the trust industry was further eroded.

Figure4-4 Basic industry trust (balance, growth and proportion)

D. Trust investment to securities was highly relevant to the capital market

Since 2013, the securities trust was highly convergent with capital market. In 2017 Q4, the securities trust reached its historical high, standing at 31.07 billion Yuan. However, in the first half of 2018, the overall downturn of the capital market led to decline of the securities trust. The securities trust declined to 2991.34 billion Yuan in Q1, and further declined to 2633.76 billion Yuan in Q2, down 11.97% Y-o-Y. Its proportion declined accordingly to 12.94%, 0.92 percentage point lower than Q1. The growth of securities trust in Q2 was merely 161.65 billion Yuan, less than half of 33.34 billion Yuan in 2017 Q2. The proportion also dropped from 9.70% in Q1 to 6.92% in Q2. In terms of sub-items, stocks and bonds investment declined sharply Y-o-Y. The growth of stocks investment was 103.26 billion Yuan, down by 45.50%. The fund investment increased by 21.52 billion Yuan, accounting for 13.31% of total growth. The bond investment increased by 36.87 billion Yuan, accounting for 22.81% of the growth. These data reflected the fact that less and less trust investment going to the capital market due to worsening market situation in 2018.

Figure4-5 Securities Trust ( balance, growth and proportion)

V. Overall risk was still under control

In recent years, risk of the trust industry remained at a relatively low level and controllable. Despite the increase in the size and number of project at risks in 2018 Q1 and Q2, the risk asset ratio was still low. It was expected that risk assets due in 2019 would decrease.

A. The size of risk assets and the number of projects at risk

increased.

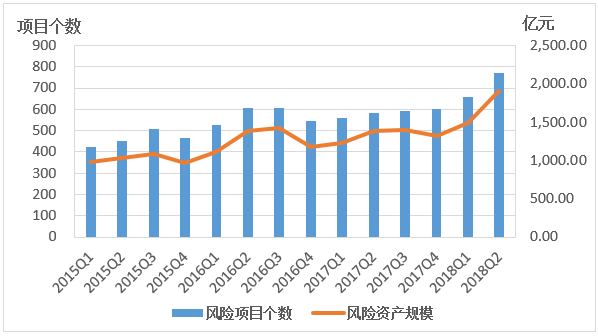

The industry risk increased in 2018 Q2. Firstly, the size of risk assets continued to increase, reaching 191.30 billion Yuan.It was the highest point since 2015, with an increase of 42.17 billion Yuan since Q1. It increased for two consecutive quarters Since 2017 Q4. Secondly, the number of projects at risk increased significantly to 773, which were 114 more than Q1. It increased continuously since 2016 Q4.

The increase of projects at risk and risk assets was closely related to the macro environment. Since the beginning of 2018, the central government intensified regulation of local government debt and real estate market. Tightening of financing channels resulted in difficulities in infrastructure financing. Local government solvency was worsening, and real estate market in certain areas was strictly monitored. Consequently, certain banks and trust cooperation projects as well as real estate trust projects experienced liquidity difficulty.The central government adjusted its macro-policy orientation, adopting more active fiscal policy and prudent monetary policy in order to maintain reasonable and abundant liquidity. Policy to address financial risks would be strengthened. The industry risk was also expected to be well managed in the future.

Figure 5-1 Changes in risk assets and projects at risk

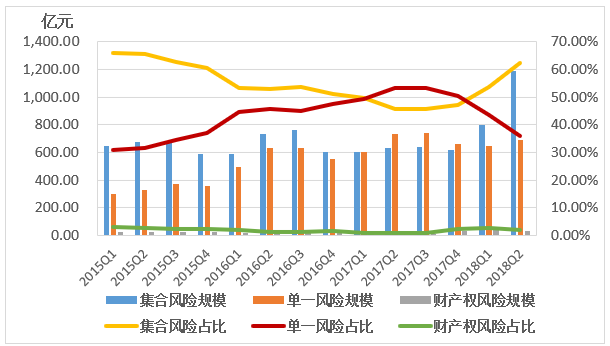

B. Risk of collective trusts increased more obviously

In terms of risk classification, the risk increase of collective trusts was more obvious, and the risk status of single and property trusts was at a lower level. As of 2018 Q2, risk assets of the collective trust were 118.94 billion Yuan, with an increase of 39.12 billion Yuan from 79.83 billion Yuan in Q1. Its proportion of risk assets rose from 53.53% in Q1 to 62.18% in Q2. As a contrast, risk assets of single trust rose from $64.99 billion in Q1 to $68.76 billion in Q2, with a modest increase of 5.80%. Its proportion dropped from 43.58% in Q1 to 35.94% in Q2, maintaining a downward trend since 2007 Q3. The size and proportion of risk assets of property rights trust decreased in Q1.

Figure5-2 Classification and proportion of risk assets

C. The risk ratio remained at a low level

The risk ratio of trust assets was defined by risk assets to trust assets, reflecting risk portfolio of the industry. In recent years, although the risk ratio fluctuated, it remained to be lower than 0.8%. The ratio was 0.79% in 2018 Q2, which was significantly higher than 0.58% in Q1. However, it was lower than 0.799% in 2016 Q2. Compared with non-performing ratio of the other financial industries, the risk assets ratio of the trust industry remained at a low level and the industry risk was under controll.

Figure5-3 Changes in risk ratio

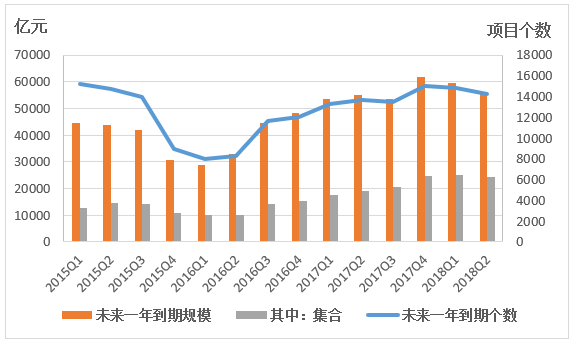

D. Risk pressure would ease in the coming year

From the perspective of maturity of trust projects in 2019, the pressure was expected to ease. The size of trust project to be mature in 2019 will be 5.57 trillion Yuan; 378.2 billion Yuan less than the forecast in Q1. It was decreasing for two consecutive quarters. The number of projects due in Q2 was expected to be 14,200, down 659 from 14,900 projected in Q1, continuing the downward trend in Q1. The size of mature collective trusts was also declining from 2.49 trillion Yuan in Q1 to 2.42 trillion Yuan in Q2. The above three indicators fully showed tha pressure was easing. Since the maturity pressure for collective trusts was decreasing, it was a good signal for the industry.

Figure5-4 Trust project matures in the coming year

VI. Improving quality of development

Reports of the 19th National Congress of the Communist Party of China pointed out that China's economy had shifted from high speed growth stage to high quality development stage. As an essential part of the financial industry, the trust industry was in a critical period manifested by decline in growth and adjustment in structure. It was also in a critical period of transition from high-speed growth to high-quality development. Looking into the future, the trust industry should take the initiative to improve the quality development

A. Better serving the real economy

Serving the real economy is fundamental for sustainable development of the financial sector. In the future, the trust industry should take serving the real economy as its priority. It also should take the initiative to fully mobilize trust facilities to meet investment and financing needs of the real economy.

Firstly, the industry should meet the long-term needs of the development of the real economy. Although confronted with more complicated internal and external challenges, the structure reform of supply side would go further in the long run. On the one hand, long-term development of real economy called for cultivation of new momentum and new industries including strategic emerging industries as well as high-end manufacturing industries. On the other hand, the structure of demand needed further adjustment. State investment to new strategic projects should be improved and comsuption should be encouraged as new driving force for economic growth. Trust industry should fully undersand development of real economy, taking advantage of its expertise to supporte financing needs of strategic emerging industries and major national strategic projects. In the meantime, the trust industry must further develop micro-finance, consumption trust and other businesses to provide financial services for consumption upgrading. It should also optimize financial services to small and medium-size enterprises, improving long-term vitality of economic development.

Secondly, the trust industry should seize the current opportunities of economic adjustment. At present, investment in key areas such as basic industries was the driving force for economic growth. With the slow-down of ecomonic growth and increasing downward pressure, development of key areas including basic industries was essential for maintaining ecomomic stability and containing of financial risks. In the second half of 2018, with adjustments of fiscal and monetary policy and relief of deleverage pressure, the trust industry must seize the opportunities to optimize its investment in real estate industry and basic industry subject to compliance requirements. On the one hand, it could take advantage of its investment experience in these areas, effectively controlling risks and improving investment value. On the other hand, it could do more contribution to growth of the real economy.

B. Business Transformation and Innovation should be strengthened

Facing the new external environment and new stage of development, the trust industry should take the initiative to strengthen business transformation and innovation. It should constantly enhance its professional capacity and strive to form a new driving force for future development of the industry.

Firstly, it should strengthen transformation and innovation of traditional business areas. In terms of investment to real estate industry, trust companies should extend financial service from loans to developers to capital investment to developers and finances to consumers by means of equity investment, ABS and REITs. The underlying assets could expand from residential buildings to commercial real estate, real estate in stock, urban renewal and other fields. In terms of micro-finance, it should make full use of its IT system, providing different products for different consumer scenarios. It should identify and control risks through credit data systems and risk models. In terms of securities investment, it should enhance capacity of active investment and asset allocation. It could rely on technical innovation including AI investment advisors to meet needs of customers with various risk preferences. By these means, it could become a crediable and professional investment institution. In terms of investments to industrial and commercial enterprises, it should take advantages of its capacity of comprehensive financial services, meeting the investment and financing needs of enterprises by menas of debt-equity linkage, debt-to-equity swap and other innovative products.

Secondly, it should accelerate development of asset securitization and property trust. These products could take full advantages of trust mechanism and revitalize stock asset. These two products were not subject to new regulations on asset management and support from the regulators was accessible. In terms of asset securitization, on the one hand, trust companies should expand underlying assets, improving professional skill and product development. On the other hand, trust companies should focus on business expansion in the inter-bank market and the exchange with diversified products. In terms of property trust, regardless of outstanding legal problems such as property registration, trust companies should promote innovation, preparing for potential business opportunities.

Thirdly, it should develop business of wealth management. Wealth management business could bring funding for products issued by the trust companies. It could also meet needs of high net worth customers and institutions. The new regulations on asset management defined the concept of qualified investor and product standard. In the future, trust companies should pay more attention to professional skills. In terms of product issuance, trust companies should focus on individual customers and non-financial institutions, enhancing influence and popularity of wealth management. Trust companies sould also devote to product innovation, connecting funding source with asset allocation. In terms of customer service, trust companies should make better use of IT technology to improve customer experience. In terms of innovation, trust companies should provide services including cash management, asset allocation and pension trust to meet needs of high-end customers.

Fourthly, the industry should promote family trust and charity trust. Although they could not generate substantial profit for the trust companies at current stage, they could demonstrate the determination of the the trust industry to return to its origin and improve quality development in the future. In terms of family trust, some trust companies introduced products such as authorized trust and family inheritance. Consequently, the customer base increased significantly. In terms of charity trust, according to official data of Ministry of Civil Affairs, 88 charity trust products were registered as of 2018 Q2 and assets under management totalled 944 million Yuan. There would be broad business opportunity in the fields including poverty alleviation, pollution prevention, education, medical treatment and culture development.

C. Compliance risks should be actively managed

Management of compliance risk was posing new challenges to the trust companies. With strengthening of supervision and increase of compliance risks, trust companies should strive to strengthen management system to control risks.

Firstly, trust companies must strengthen compliance awareness and improve risk management. In recent years, intensive regulatory policies were introduced and regulatory penalties were more frequent. The regulatory authorities emphasized principle of penetration in terms of compliance requirements, which demanded trust companies to attach great importance to compliance risk in the future. On the one hand, trust companies should vigorously enhance staff awareness of compliance with comprehensive understanding of regulatory policies. On the other hand, trust companies should strengthen compliance management, with timely communication with regulators.

Secondly, trust companies should enhance specialization and sophistication of risk management. At present, increase of compliance risks demanded trust companies to further strengthen risk management to resolve project at risks and address potential risks. On the one hand, risk management should be specialized in line with business development, timely identifying key risks in different business line to improve efficiency of risk management. On the other hand, risk management should be more sophisticated. Due to net value requirements defined in the new regulation on asset management, duration management should be prioritized. In the future, trust companies should establish comprehensive risk management system to meet requirements of the regulation on asset management as well as business expansion need.