20/F, Building 5, Yard 1, Yuetan South Street, Xicheng District, Beijing China Code:100033

Tel: 010-68063910 Fax: 010-68066630

Copyright 2004-2017 All Rights Reserved. China Trustee Association

京ICP备 19023601号

In 2018 Q4, Chinese economy grew by 6.4% compared with 6.5% in Q3, facing with great downward pressure. Considering changes in external environment, macro economic policy was fine-tuned, forming powerful driving forces for high-quality development, and positive signs were emerging. China Trustee Association released business data of trust companies in 2018 Q4.The indicators showed that market confidence was boosted to keep the economy running within a reasonable range. The trust industry kept up with the pace of economic development by timely adjusting its priorities. The trust industry was transforming from high speed growth to high quality development. Compared with 2018 Q3, four new characteristics were witnessed. Firstly, the size of the trust assets under management declined continuously, while asset quality was improving. The capability to efficiently allocate assets was strengthened. Secondly, risk management capacity was increased to address financial risks. Although the business size was shrinking, the Y-o-Y per capita profit was increased due to improved efficiency. Thirdly, the proportion of single pecuniary trust decreased gradually, and the proportion of collective pecuniary trust which reflected active management capability of trust companies increased steadily. It showed improved quality of the growth of trust industry. Fourthly, the industry reached consensus to serve the real economy. Although the total numbers of pecuniary trust projects decreased, the proportion of funding to industrial and commercial enterprises increased steadily.

I. The size of trust assets decreased

A. Trust assets

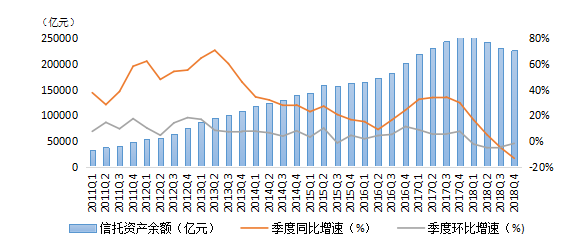

In April 2018, Guiding Opinions on Regulating the Asset Management Business of Financial Institutions (the so-called "new guidelines on asset management") put forward requirements of resolving existing risks and strictly preventing the potential increscent risks. As of 2018 Q4, the trust assets of 68 trust companies decreased to 22.70 trillion Yuan, down 13.50% from 2017 Q4. The quarterly growth rate was -2.41% in Q1, -5.25% in Q2, -4.65% in Q3 and -1.89% in Q4. In 2018, the size of trust assets decreased by 632.24 billion Yuan, 1344.62 billion Yuan, 1129.23 billion Yuan and 437.95 billion Yuan each quarter of. The reduction in Q4 was significantly less than that in Q2 and Q3, and the size of trust assets was stable with minor fluctuation in Q4.

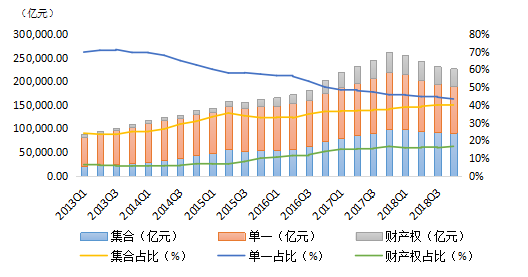

Figure 1 Changes of trust assets

The curve of asset size and the Y-o-Y growth rate in figure 1 showed that the size increased in 10 quarters from 2015 Q3 to 2017 Q4, before it decreased consecutively in 4 quarters of 2018. The difference between the Y-o-Y and quarterly growth rate in Q4 indicated that it might be a "turning point". To be specific, the Y-o-Y growth rate in Q4 continued to decline, while the quarterly growth rate was smoothly and the size of trust assets remained stable. At present, the dual tasks facing the trust industry were controlling financial risks and resolving underlying risks. At the same time, the industry should actively promote business transformation and avoid ups and downs of asset size with strong control of risks. In the next step, the trust industry should play its unique role in improving capital allocation efficiency with forward-looking perspective. It was expected that the growth rate in the next quarter would be stable with minor fluctuation.

B. Proprietary assets

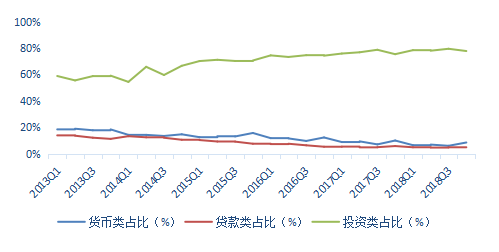

As of 2018 Q4, the size of proprietary assets reached 719.32 billion Yuan, up 9.34% from 657.90 billion Yuan in 2017 Q4. In terms of quarterly growth rate, it was 1.57%, 3.16% and 0.15% respectively in the first three quarters of 2018.It reached 4.19% in Q4. Since 2014 Q3, investment of proprietary assets increased steadily. It accounted for 75.41% of the total proprietary assets in 2017 Q4 and 78.45% in 2018 Q1, up 3% from the previous quarter. Its proportion in 2018 Q4 was 77.79%, higher than 2017 Q4 and slightly lower than the first three quarters of 2018. In terms of size of investment assets, the quarterly growth rate was 5.67%, 2.62%, 2.03% and 1.94% respectively.

Figure 2 Changes in use of proprietary assets

The changes of money assets in 2018 showed two characteristics. Firstly, it reached 60.98 billion Yuan in 2018 Q4, down 7.16% Y-o-Y. It accounted for 8.48% of the total, slightly lower than 9.98% in 2017 Q4. Secondly, its proportion in the first three quarters of 2018 was 6.45%, 6.90% and 5.97% respectively. It increased to 8.48% in Q4, which reflected that trust companies intended to increase liquidity to cope with unexpected business risks at the end of the year.

Loan assets in 2018 Q4 were 35.49 billion Yuan, down 6.79% from 2017 Q4. Its proportion was 4.93%, down from 5.79% in 2017 Q4.

C. Owners' equity and risk provision

As of 2018 Q4, the owner's equity was 574.93 billion Yuan, up 9.50% Y-o-Y. The quarterly growth rate was 1.51%, 1.68%, 1.09% and 4.94% respectively. In terms of structure of owners' equity, the paid-in capital was 265.42 billion Yuan, accounting for 46.16% of the total, down 1.4% from 2018 Q3. It remained basically unchanged compared with 46.05% in 2017 Q4.

In order to enhance capability to expand business and control risks, trust companies strived to enhance capital strength. Normally, the Y-o-Y growth rate reflected difference between years, while the monthly growth rate indicated short-term adjustments of the industry when facing with economic changes. The capital strength had great influence of the business size. As long as Chinese economy continued to grow, trust companies, especially small companies, would stick to the strategy to enhance capital strength by all means. As long as the economy warms up, small and medium-sized trust companies will be more active in capital-raising in 2019.

As of 2018 Q4, the undistributed profit was 163.13 billion Yuan, accounting for 28.37% of the total, remained basically unchanged from 28.29% in Q2 and 28.45% in Q3.

Confronted with slowing-down of Chinese economy and increase of financial risks, the trust industry improved risk provision as a preparation for potential loss. As of 2018 Q4, the provision was 26.07 billion Yuan, up 17.90% Y-o-Y, added 3.96 billion Yuan compared with 22.11 billion Yuan in 2017 Q4. The quarterly growth rate was 9.64%, up from 23.78 billion Yuan in Q3. The ratio of provision to owners' equity increased from 4.21% in 2017 Q4 to 4.34% in 2018 Q3 and 4.53% in 2018 Q4. It reflected that the trust industry's enhanced risk provision regardless of decrease of trust assets.

D. Projects at risk

According to the data of China Trustee Association, projects at risks in 2018 Q3 increased by 59 compared with 2018 Q2. The size of the projects at risk increased by 12.90% compared with the 191.30 billion Yuan in Q2. The total number was 872 in Q4, 40 more than that of Q3. The size was 222.19 billion Yuan, up 2.88% from 215.97 billion Yuan in Q3.The risk rate was 0.98%, up 0.05 percentage point from 0.93% in Q3. With the guidance of the regulator to control incremental risks, the trust industry took great efforts to investigate hidden risks of stock trust projects in order to mitigate potential risks

.

Figure 3 Changes in project at risks

The industry's awareness of risk management and control should not be relaxed. The measures for risk management and control should be put in place. The so-called "blind spots" and "minefields" should be eliminated, and the bottom line of containing systemic risks should be firmly guarded.

II. Business performance improved

On October 31, 2018, the political bureau of the central committee of the communist party of China (CPC) proposed the principle of "six stability" in order to effectively respond to changes in the external economic environment and ensure smooth performance of the economy. The trust industry unswervingly implemented the policy by accelerating transformation and strengthening risk control. As a result, the business performance was improved to a new level.

A. Business performance

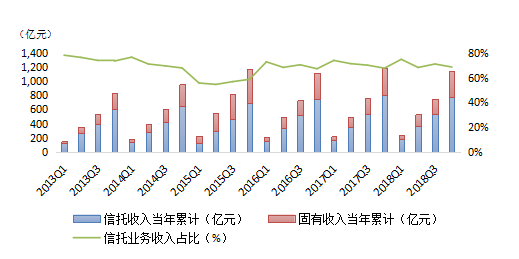

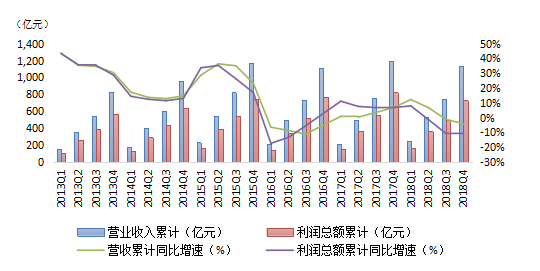

Typically, revenue peaks in Q4 of a year. The industry revenue reached 39.30 billion Yuan in 2018 Q4, down 9.53% from 43.44 billion Yuan in 2017 Q4. Compared with 23.43 billion Yuan in Q3, the quarterly growth rate was 67.69%, whichindicated that the trust industry was positively affected by policy adjustment.

Figure 4 Changes of trust business revenue

The revenue totaled 25.09 billion Yuan in 2018 Q4, down 8.88% from 27.53 billion Yuan in 2017 Q4. It accounted for 63.83% of the total income. This proportion was down from 71.93% in Q3. It could be attributed to increase of investment income. After years of enhancement of capital position, many trust companies improved their investment capacity and strength. The investment income reached 8.93 billion Yuan in 2018 Q4, down 26.30% from 12.12 billion Yuan in 2017 Q4, and up 93.52% from 4.62 billion Yuan in 2018 Q3. Investment income accounted for 22.73% of the total, higher than 19.69% in 2018 Q1.

Figure 5 showed that the profit growth in 2018 Q2 and Q3 was significantly slowing down. In 2018 Q4, the profit was 23.74 billion Yuan, down 12.19% from 27.03 billion Yuan in 2017 Q4, down 76.64% from 13.44 billion Yuan in Q3. The strong improvement of business performance in Q4 was closely related to policy adjustment。It was also because some trust companies laid out new business strategies and grabbed business opportunities. Although many trust companies witnessed profit decline, some trust companies seized the opportunities to grow business. In 2018 Q4, interest income reached 2.08 billion Yuan, down 6.30% from 2.22 billion Yuan in 2017 Q4. Overall, revenue and profit in Q4 were flat compared with the previous three quarters.

Figure 5 Changes in revenue and profit

As the countercyclical adjustment of macro economic policy intensified, the government’s anticipatory adjustment and fine-tuning would be more accurate. The uncertainties of market expectations could be eliminated. Profit growth would be more stable in 2019 Q1.The fluctuations in 2018 would not change the upward trend of Chinese economy.

B. Return for beneficiariesSince 2018 Q2, the economy was facing with intensified downward pressure. It inevitably affected the real return rate of trust projects. In December 2018, 1947 projects were closed. The annualized comprehensive real return rate was 4.91%, down from 5.57% in Q2 and 5.05% in Q3.It was decreased by 4.51 percentage points from 9.42% in December 2017.

The economic performance would never be a horizontal line, nor would it be a downward line. When the economy slowed down and started to pick up,the annualized comprehensive real return rate would generally follow its pattern.

III. Sources and use of trust funds improved

A. Funding Sources

In 2018, the trust industry accelerated transformation under the regulatory pressure of eliminating channel business. The industry made visible achievements in diversification of funding sources. The proportion of collective pecuniary trust increased, and that of single pecuniary trust decreased. The proportion of property trust under management remained stable. Both figure 6 and figure 7 illustrated transformation of funding sources. To be specific, single pecuniary trust from institutional clients was declining gradually. Both collective pecuniary trust and property trust were growing. Before 2016 Q4, single pecuniary trust accounted for more than half of the total.

Figure 6 Changes in sources of trust assets

As of 2018 Q4, the collective pecuniary trust totaled 9.11 trillion Yuan, accounting for 40.12% of the total, up 2.38 percentage points Y-o-Y. The single pecuniary trust totaled 9.84 trillion Yuan, accounting for 43.33%, down 2.4 percentage points Y-o-Y. The property trust was 3.76 trillion Yuan, accounting for 16.55%.

In terms of quarterly growth rate, single pecuniarytrust decreased by 3.83%, 7.03% and 5.44% respectively in the first three quarters of 2018, and down 4.00% in Q4. Property trust decreased by 7.14%, 2.98% and 6.65% in the first three quarters, and increased by 3.01% in Q4. Changes in Q4 reflected diversification of funding structure.

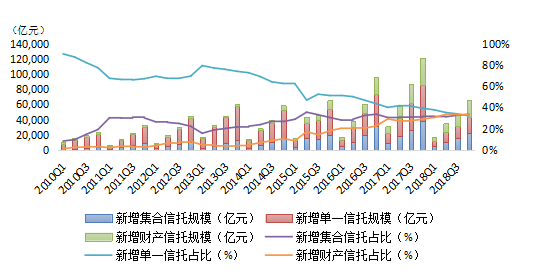

Figure 7 Changes in new funding sources

Since the release of the "new Guidance on Asset Management", the proportion of new non-discretionary management trust products decreased. In 2018 Q4, its proportion declined and was even lower than that of collective fund trust and property trust among new products. 2018 Q4 could be a watershed for transformation and development of the trust industry. The collective pecuniary trust and property trust overtook single pecuniary trust, reflecting rapid transformation of the industry.

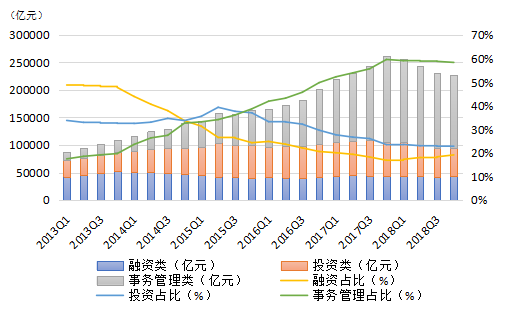

B. Use of trust assets

Reduce the proportion of financing trust was priority of the trust industry. As of 2018 Q4, financing trust accounted for 19.15% of the total, down 28 percentage points from 47.76% in 2013 Q4. No significant change was witnessed in 2018 Q4.

Figure 8 Changes in use of trust assets

On August 17th 2018, the Trust Companies Supervision Department of the CBIRC issued a notice to strengthen regulation during the transition period of asset management business. It was provided that the regulator would support non-discretionary managementproducts that were fully compliant .On the other hand, the regulator was determined to crack down channel business of regulatory arbitrage. The policy had great impacts on fund allocation strategy of the trust industry in Q4. In terms of quarterly growth rate, the non-discretionary management trust decreased by 3.22%, 5.56% and 4.83% in the first three quarters respectively, and decreased by 2.66% in Q4. This fine-tuning of regulatory policy was of great significance to financial stability and economic growth.

C. Allocations of trust funds

Serving the real economy was fundamental to control systemic risks. In accordance with so-called “six stability” requirements, the trust industry strived to balance the relationship between business growth and risk control, supporting implementation of major national strategies with improved efficiency. In 2018 Q3 andQ4, the trust industry focused on funding industrial and commercial enterprises as well as infrastructure sector.

As of 2018 Q4, the size of fund trust was 18.95 trillion Yuan, down 13.51% from 21.91 trillion Yuan Y-o-Y. Funding to industrial and commercial enterprises ranked first(29.90%), followed by funding to financial institutions (15.99%), basic industry (14.59%), real estate industry(14.18%) and securities market (11.59%). In terms of new trust assets, funding to industrial and commercial enterprises was also in the first place (37.45%), followed by real estate industry (20.03%), financial institutions (8.67%), basic industry (6.54%) and securities market (3.43%).

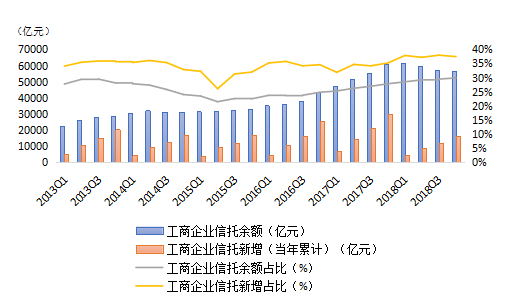

1. Funding to industrial and commercial enterprises

As of 2018 Q4, the size of funding to industrial and commercial enterprises was 5.67 trillion Yuan, down 7.12% from 6.10 trillion Yuan Y-o-Y. The size decreased by 3.32%, 3.38% and 1.47% quarterly since 2018 Q2.Simultaniously, its proportion grew steadily, accounting for 29.90% in 2018 Q4, an increase of 2 percentage points from 27.84% in 2017 Q4.

As of 2018 Q4, funding to the manufacture sector was 571.28 billion Yuan, up 1.29% from 563.99 billion Yuan in 2017 Q4, up 2.85% from 555.48 billion Yuan in 2018 Q3.

Figure 9 Growth of funding to industrial and commercial enterprises

From 2018 Q2 to Q4, funding to information transmission, computer service and software sectors was 246.16 billion Yuan, 242.22 billion Yuan and 238.46 billion Yuan respectively. Funding to these sectors did not significantly decline along with the business size.In addition, funding to science and technology service sector maintained growth. As of 2018 Q4, the size was 102.26 billion Yuan, up 26.29% from 80.93 billion Yuan in 2017 Q4 and up 5.90% from 96.51 billion Yuan in 2019 Q3.Regardless of a Y-o-Y decreased of 13.51% of money trust in 2019 Q4 ,funding to these sectors grew.

In terms of the newly added fund, new funding to industrial and commercial enterprises was 1.63 trillion Yuan, accounting for 37.45% of the total. The trust industry provided strong financial support to promote high-quality development of most real economy sectors.

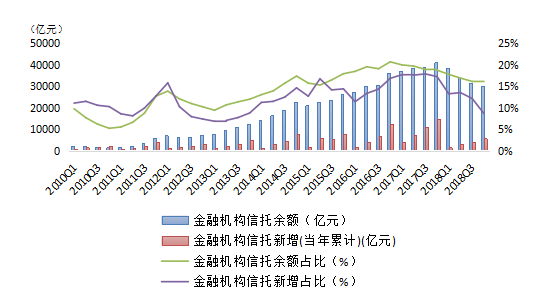

2. Funding to financial institutions

As of 2018 Q4, funding to financial institutions was 3.03 trillion Yuan, down 26.29% from 4.11 trillion Yuan in 2017 Q4 and down 3.70% from 2018 Q3. Its proportion decreased from 16.14% in 2018 Q3 to 15.99% in 2018 Q4, when remaining the second largest area of moneytrust allocation.

Figure 10 Growth of funding to financial institutions,

Inter-bank financial cooperation with abnormal frequency implied hidden cross sector risks. In 2018 Q4, the supervision of inter-bank cooperation remained tense. Funds from banks and other financial institutions decreased significantly thus reduced the proportion from 12.15% in 2018 Q3 to 8.67% in terms of new funding allocation.

3. Funding to the basic industry

The size of funding to the basic industry was 2.76 trillion Yuan. Although it was down 12.92% from 3.17 trillion Yuan in 2017 Q3, its proportion remained from 14.40% to 14.64% in 2018. Its size was affected by policy on cooperation between trust companies and governmental agencies. However, the policy was fine-tuned in the second half when the state emphasized the importance of infrastructure construction. Funding to infrastructure kept decreasing in Q4 due to lag off of the policy effect. Its proportion was decreased from 9.91% in Q3 to 6.54% in Q4. In terms of newly added fund, it was 116.20 billion Yuan, up 32.55% from 87.67 billion Yuan in Q3. The policy effect of expanding investment in infrastructure began to appear.

Figure 11 Growth of funding to the basic industry

Infrastructure investment was essential to maintain economic development and social stability. Trust companies should be well prepared to growing number of infrastructure projects in 2019.It could also be expected that cooperation between trust companies and governmental agencies would be well regulated. Trust companies should be cautious and only choose business partners in regions with strong fiscal capacity.

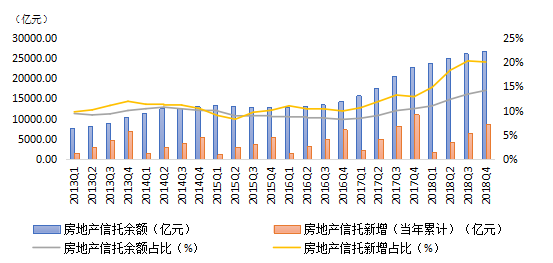

4. Funding to real estate industry

Funding to real estate industry grew and its proportion increased by 0.5-1.5 percentage points quarterly. As of 2018 Q4, the proportion was 14.18%, 0.76 percentage point higher than 13.42% in 2018 Q3, 3.76 percentage points higher than 10.42% in 2017 Q4.As of 2018 Q4, the size was 2.69 trillion Yuan, up 17.72% from 2.28 trillion Yuan in 2017 Q4,up 2.76% from 2.62 trillion Yuan in 2018 Q3.

Figure 12 Growth of funding to real estate industry

In terms of the newly added fund, funding to the real estate industry accounted for 20.03% due to high return rate.

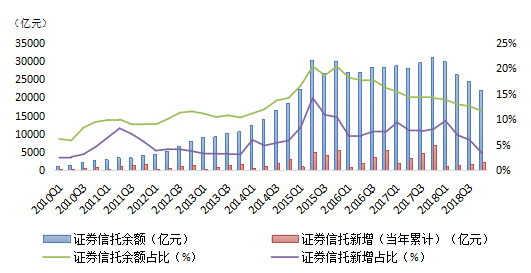

5.Funding to securities investment

Affected by recession in the securities market, funding to securities investment declined sharply since 2018 Q2.As of 2018 Q4, the size was 2.20 trillion Yuan, down 29.17% from 3.10 trillion Yuan in 2017 Q4. It was down 10.38% quarterly. The proportion fell from 14.15% in 2017 Q4 to 11.59% in 2018 Q4. In terms of the newly added fund, the proportion decreased from 5.97% in 2018 Q3 to 3.43% in 2018 Q4.

Figure 13 Growth of funding to securities investment

In 2019, the trust industry should resolutely implement decisions and strategies of CPC central committee and the state council, endeavoring to prevent and control major risks, enhancing its capacity to serve the real economy. In 2019, the trust industry should maintain its momentum, returning to its origin, speeding up transformation and containing and resolving risks.